Nigeria’s Energy Consumption Demands Reach Critical Juncture

By: Gerelyn Terzo of Sharemoney

Nigeria’s energy sector has grabbed the spotlight as it faces a critical juncture on its path to reaching its full potential. Ahmad Zakari, senior special assistant to President Muhammadu Buhari on power infrastructure, said at a recent energy event that Africa’s largest economy requires 50,000 MW of power to satisfy its energy consumption needs amid a history of a failing electricity grid. Currently, they are at about 12,500 MW of installed energy capacity.

Even with over 10,000 MW of installed energy capacity, the country’s grid only delivers about one-third of that during peak demand. As a result, energy blackouts are an all-to-frequent occurrence in the nation, mainly in rural areas without access to the grid as opposed to urban cities such as Lagos.

As recently as September, Nigeria’s electricity grid buckled, leaving wide swaths of the country without access to power. The latest failure marks the fourth such collapse of Nigeria’s power grid so far in 2022.

According to Power for All, a global organization dedicated to renewable energy, over 90 million Nigerians — or 55% of their population — are without access to electricity, placing it among the biggest three countries in the world with energy deficits, alongside Ethiopia and the Democratic Republic of Congo.

Meanwhile, the Nigerian population of 200 million-plus is forced to buy diesel fuel to keep their personal power generators running. Worse, the developing economy has not been immune to the global inflation trend, which has triggered a threefold increase in the price of diesel to N800 per liter, fueled by the disruptions caused by Russia’s war in Ukraine. According to Energy Commission of Nigeria data, the country doles out some $22 billion yearly on power generators.

To help, Nigerian officials aim to migrate from an on-grid to an off-grid model comprising structures like mini-grids and solar home systems (SHS) to satisfy the country’s massive energy demands. Not only would greater power generation help to meet the everyday needs of Nigerians, but it would also pave the way for the further development of more power infrastructure in the African nation.

Zakari explained how infrastructure investment over time has failed to keep pace with Nigeria’s rapid population growth, which has left a gap between supply and demand in the country. He pointed to households that cannot access power altogether, calling it the country’s responsibility to deliver power generation by developing strategically located energy grids.

Energy Stakeholders

Nosa Igbinedion, general manager of power procurement and regulatory at Eko DisCo, describes Nigeria’s power problem as a “lack of coordination” among stakeholders. However, this situation may change, potentially catalyzing greater power generation in Nigeria.

For example, Geregu Power Plc, owned by billionaire Femi Otedola, made its debut on the Nigerian Exchange’s Main Board in early October, making it a publicly traded entity in which others can invest.

Image by Twitter

Geregu Power’s listing has instilled stakeholders’ confidence in Nigeria’s energy sector. The company has a solid reputation already, and listing its shares on the exchange has been a bonus, analysts say. Investors have their first opportunity to gain direct exposure to the country’s power generation system in the private sector.

There have been many problems preventing investors from jumping in. Nigeria’s power producers are known for having outstanding balances with natural gas suppliers. Officials claim there have been technical failures that have been exacerbated by disruptions in the workforce in which transmission company workers have been on strike. Nigerian businesses have blamed the lack of reliability in the nation’s power grid as a major roadblock to economic growth. The biggest hindrance has been insufficient financing to build out the energy infrastructure needed to meet the needs of both rural and urban areas.

However, investors who may have remained on the sidelines before due to a lack of confidence in Nigeria’s power grid’s ability to deliver profits might have a change of mind. The public listing reflects a market and commercial value for power generation in the country, analysts say, which bodes well for future investors and partners.

Clean Energy Push

One possible way in which Nigeria can meet its energy demands is through clean energy generation, which by some metrics, has been a stumbling block in the country. For example, Nigeria’s solar power adoption hovers at less than 2%, leaving the business community to express doubts that this renewable energy source is conducive to large-scale adoption.

Another way to express it is through installed photovoltaic solar panels per capita, which in Nigeria amounts to a single watt vs. 8 watts on average in fellow emerging economy South Africa. In addition, over 90% of Nigeria’s solar parts are imported, yet another stumbling block to acceptance. However, Nigeria’s clean energy tide could be about to turn. The catalyst is soaring diesel prices that have resulted from the prolonged war in Ukraine.

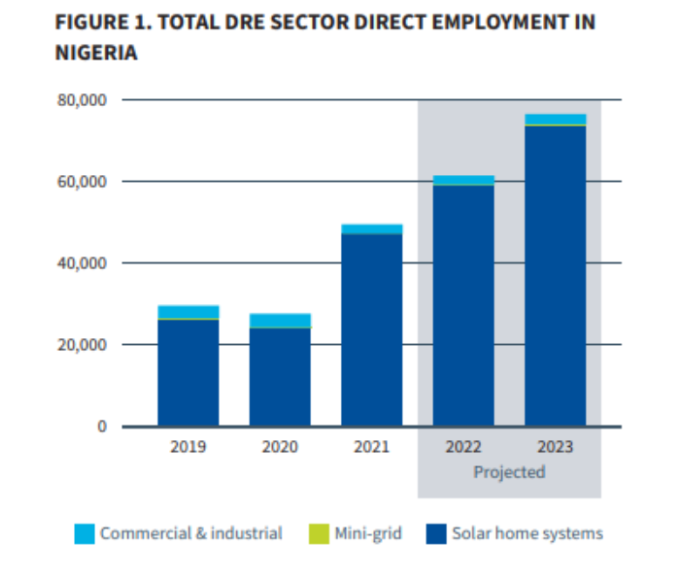

A new report by Power for All reveals that renewable energy is on the rise in Africa’s most populous nation and will add to the number of jobs in the economy in the coming year. The report suggests that Nigeria’s solar power sector will pave the way for another 76,000 new jobs in the economy by 2023 across home solutions, commercial, and industrial appliances. This compares with a workforce of 32,000 as of 2019. By 2021, Nigeria’s solar industry employed some 50,000 individuals.

Source: Power for All

Jobs in Nigeria’s solar sector are expected to surpass the country’s oil and gas industry, where some 65,000 locals are employed. Despite its inadequate power supply, Nigeria ranks as Africa’s No. 1 crude oil producer as of August 2022 and sits on one of the world’s biggest natural gas reserves.

The Power for All report is the result of a poll on employment and pay across several hundred companies in nearly half-a-dozen nations. In addition to Nigeria, these countries included Ethiopia, India, Kenya, and Uganda. Nigeria shined as the “fastest post-pandemic recovery and growth in decentralized renewable energy jobs,” according to the report.

If Nigeria can harness its potential for power generation across fossil fuels and clean energy sources, Sub-Saharan Africa’s biggest economy stands a better chance of meeting its vast power consumption needs sooner than later.